Looking for a safe investment that gives steady monthly income? The Post Office Monthly Income Scheme (POMIS) in 2025 is one of the simplest options. In this article, we’ll break down how it works, current rates, realistic calculations, pros and cons, so you can see if it’s right for you.

Understanding the Post Office Monthly Income Plan 2025

POMIS is a government-backed savings scheme where you deposit a lump sum for five years. In return, you get monthly interest payments, and your principal is returned at maturity.

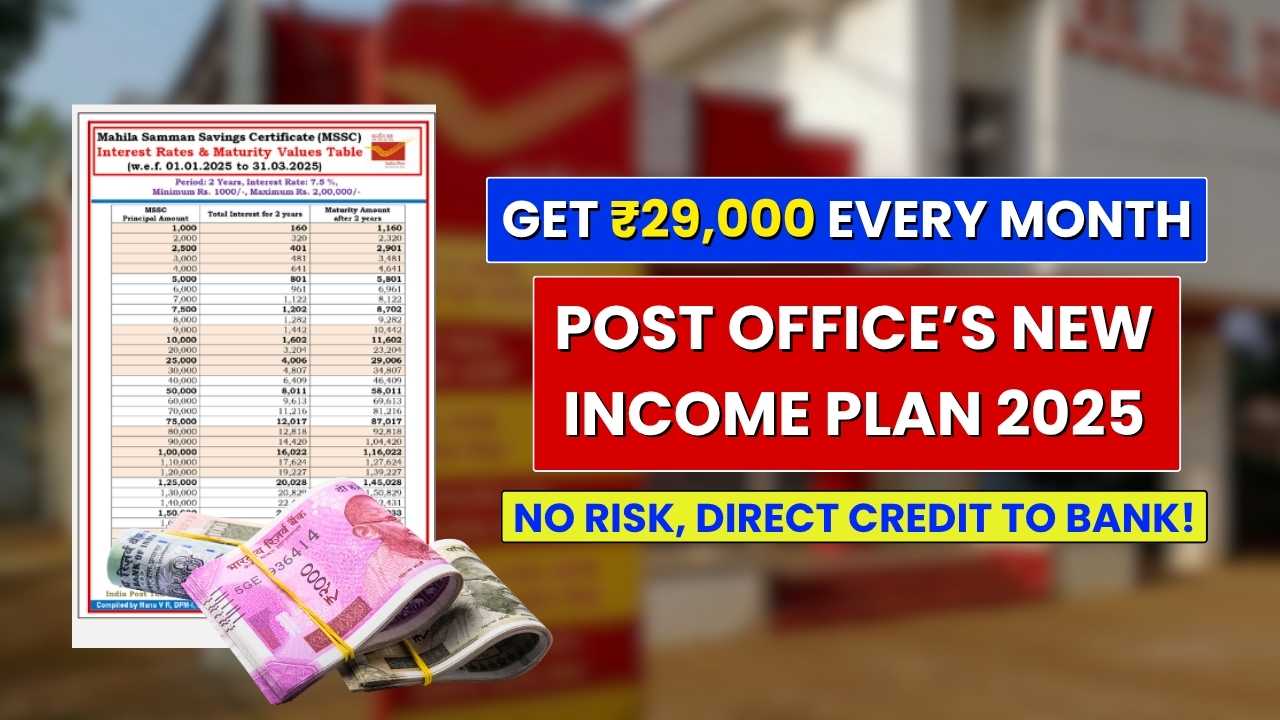

For 2025, the interest rate is 7.4% per annum, paid monthly. The “₹29,000 every month” figure is possible only if you combine maximum allowed deposits across multiple accounts or family members.

Key Features of POMIS in 2025

| Feature | Details |

|---|---|

| Interest rate | 7.4% per annum |

| Tenure | 5 years |

| Minimum deposit | ₹1,000 |

| Maximum deposit – single account | ₹9 lakh |

| Maximum deposit – joint account (up to 3 adults) | ₹15 lakh |

| Monthly interest payout | Yes |

| Risk | Very low – backed by Government of India |

How Monthly Income Works? Realistic Calculations

Step-by-Step

- Deposit your lump sum in POMIS.

- Annual interest is calculated at 7.4% of your deposit.

- Interest is divided by 12 and credited monthly.

- Principal is returned at maturity after five years.

Example Calculations

Scenario A – Single account (₹9 lakh)

- Annual interest: 9,00,000 × 7.4% = ₹66,600

- Monthly interest: 66,600 ÷ 12 ≈ ₹5,550

Scenario B – Joint account (₹15 lakh)

- Annual interest: 15,00,000 × 7.4% = ₹1,11,000

- Monthly interest: 1,11,000 ÷ 12 ≈ ₹9,250

Scenario C – Multiple accounts totaling ₹45 lakh

- Annual interest: 45,00,000 × 7.4% = ₹3,33,000

- Monthly interest: 3,33,000 ÷ 12 ≈ ₹27,750

This is close to the “₹29,000/month” figure often mentioned, but it requires large combined deposits across multiple accounts.

Why POMIS Is Attractive

- Safety: Principal is backed by the government.

- Monthly income: You don’t have to wait for 5 years.

- Simplicity: No market risk or complex calculations.

- Predictable returns: Monthly payouts are fixed based on the invested amount.

Things to Consider Before Investing

- Inflation: 7.4% may feel low if inflation is high.

- Taxation: Interest is fully taxable as income from other sources.

- Liquidity: Principal is locked for five years; early withdrawal incurs penalties.

- Realistic income: “₹29,000/month” is only achievable with maximum contributions.

Tips to Make the Most of POMIS

- Use joint accounts or coordinate with family members to maximize allowed deposits.

- Keep bank account and KYC details updated for smooth monthly credit.

- Reinvest monthly interest if you don’t need it immediately.

- Consider combining POMIS with other investments for inflation protection.

- Plan for taxes on the interest to know your net monthly income.

Latest Update for 2025

- Interest rate remains 7.4% per annum, payable monthly.

- Maximum deposits are ₹9 lakh for a single account and ₹15 lakh for joint accounts.

- The scheme continues under the same rules as in previous years.

Conclusion

POMIS is ideal if you want safety, predictable monthly income, and simplicity. However, reaching ₹29,000 per month requires a very large investment across multiple accounts. Use the calculations above to understand what you can realistically earn and plan accordingly.

FAQs

What’s the minimum deposit for POMIS?

₹1,000 in multiples of ₹1,000.

Is the interest rate of 7.4% fixed for 5 years?

Yes, for your account, but new deposits may have different rates in the future.

Can I withdraw my deposit before 5 years?

Yes, but early withdrawal includes penalties.

Is monthly interest taxable?

Yes, it is taxable as income from other sources.

Can I open multiple POMIS accounts to increase income?

Yes, as long as total deposits do not exceed maximum limits: ₹9 lakh for single, ₹15 lakh for joint accounts.